Data Scientist, Credit Suisse

Big Data & Analytics architect, Amazon

Global Data Community Lead | Lead Data Scientist, Thoughtworks

Principal Software Engineer, Afiniti

In this data science project, you will work with German credit dataset using classification techniques like Decision Tree, Neural Networks etc to classify loan applications using R.

Get started today

Request for free demo with us.

Schedule 60-minute live interactive 1-to-1 video sessions with experts.

Unlimited number of sessions with no extra charges. Yes, unlimited!

Give us 72 hours prior notice with a problem statement so we can match you to the right expert.

Schedule recurring sessions, once a week or bi-weekly, or monthly.

If you find a favorite expert, schedule all future sessions with them.

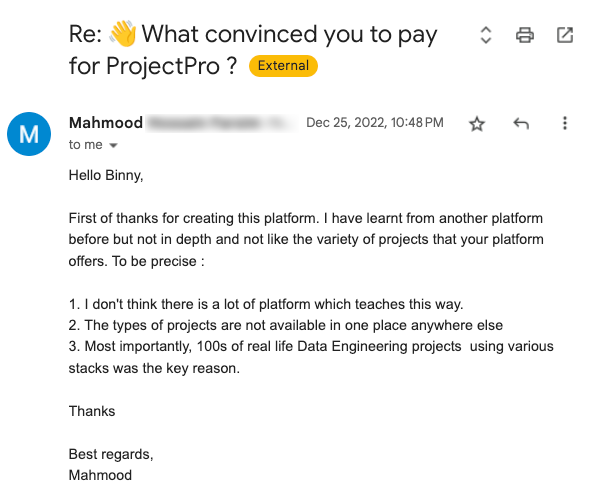

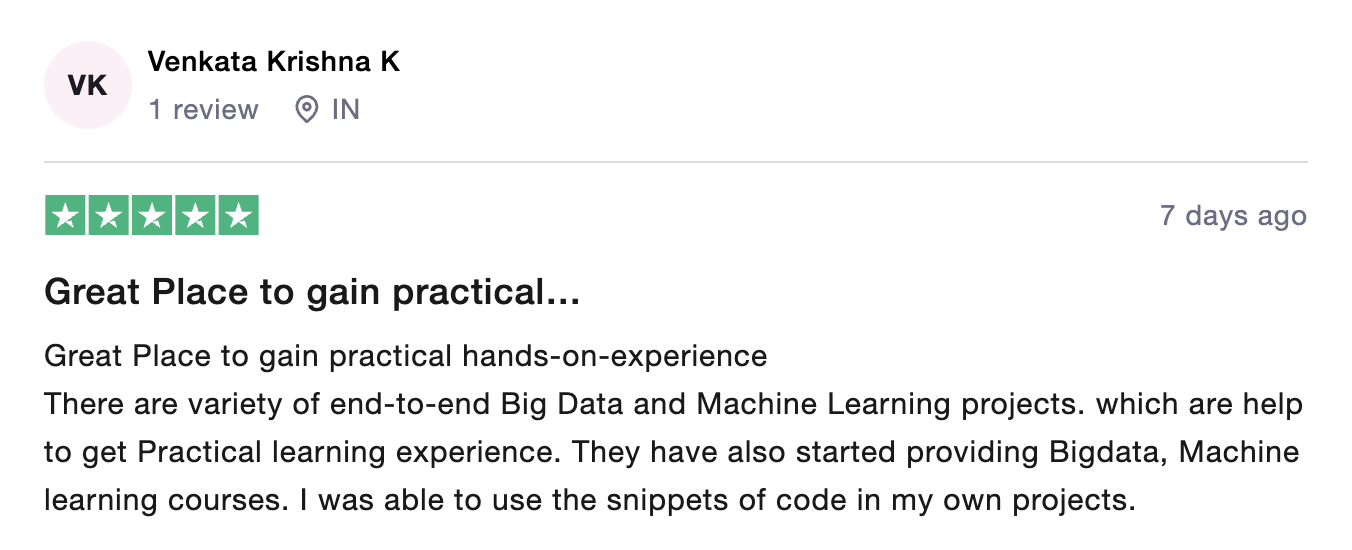

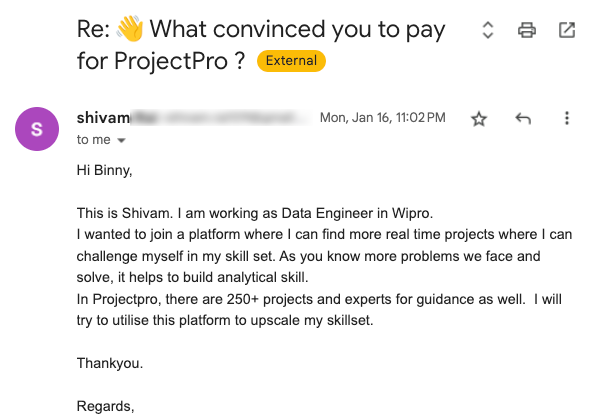

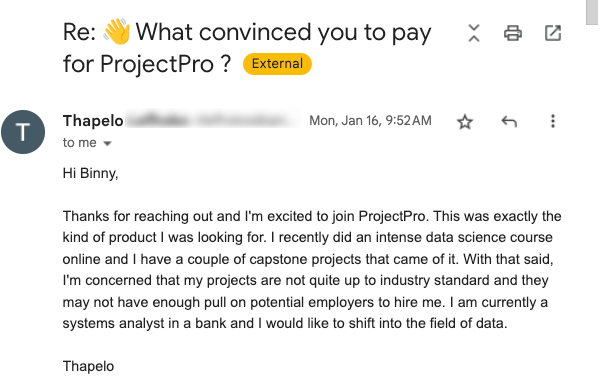

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

Source: ![]()

250+ end-to-end project solutions

Each project solves a real business problem from start to finish. These projects cover the domains of Data Science, Machine Learning, Data Engineering, Big Data and Cloud.

15 new projects added every month

New projects every month to help you stay updated in the latest tools and tactics.

500,000 lines of code

Each project comes with verified and tested solutions including code, queries, configuration files, and scripts. Download and reuse them.

600+ hours of videos

Each project solves a real business problem from start to finish. These projects cover the domains of Data Science, Machine Learning, Data Engineering, Big Data and Cloud.

Cloud Lab Workspace

New projects every month to help you stay updated in the latest tools and tactics.

Unlimited 1:1 sessions

Each project comes with verified and tested solutions including code, queries, configuration files, and scripts. Download and reuse them.

Technical Support

Chat with our technical experts to solve any issues you face while building your projects.

7 Days risk-free trial

We offer an unconditional 7-day money-back guarantee. Use the product for 7 days and if you don't like it we will make a 100% full refund. No terms or conditions.

Payment Options

0% interest monthly payment schemes available for all countries.

The German credit dataset contains information on 1000 loan applicants. Each applicant is described by a set of 20 different attributes. Of these 20 attributes, seventeen attributes are discrete while three are continuous. The main idea is to use techniques from the field of information theory to select a set of important attributes that can be used to classify tuples. In this data science project, you will train a neural network using these attributes; the neural network is then used to classify tuples.

Recommended

Projects

Best MLOps Certifications To Boost Your Career In 2024

Chart your course to success with our ultimate MLOps certification guide. Explore the best options and pave the way for a thriving MLOps career. | ProjectPro

How to Ace Databricks Certified Data Engineer Associate Exam?

Prepare effectively and maximize your chances of success with this guide to master the Databricks Certified Data Engineer Associate Exam. | ProjectPro

Learning Artificial Intelligence with Python as a Beginner

Explore the world of AI with Python through our blog, from basics to hands-on projects, making learning an exciting journey.

Get a free demo